The International Air Transport Association (IATA) has released results for the July 2023 global air cargo markets, which show a continued trend of recovery in growth rates since February. July air cargo demand was just 0,8% below year-ago levels. While demand is now broadly flat compared to 2022, this is an improvement on the performance of recent months, a particularly significant fact considering declines in global trade volumes and growing concerns about China's economy.

- Global demand, measured in cargo tonnes per kilometer (CTKs*), was 0,8% below July 2022 levels (-0,4% in international operations). This was a significant improvement over the previous month's performance (-3,4%).

- Capacity, measured in tons of available cargo per kilometer (ACTKs), rose 11,2% compared to July 2022 (10,8% in international operations). The strong increase in the ACTK indicator is a reflection of the increase in cargo capacity on passenger flights (29,3% year on year) due to the summer season in the northern hemisphere.

The main factors that influenced cargo operations are:

- In July, both the manufacturing PMI (49,0) and the new export orders PMI (46,4) fell below the critical threshold of 50, indicating a decline in manufacturing output and global exports.

- Global international trade declined for the third consecutive month in June, down 2,5% year-on-year, reflecting the slowing demand environment and challenging macroeconomic conditions. The gap between the annual growth rates of air cargo and global merchandise trade narrowed to -0,8 percentage points in June. While air cargo growth still lags global trade, the gap is the smallest since January 2022.

- In July, the global supplier lead time PMI was 51,9, indicating fewer delays in the supply chain. All major economies except China had PMIs above 50. The United States, Europe and Japan recorded PMIs of 54,2, 57,7 and 50,4, respectively.

- Inflation presented a mixed picture in July, with the rise in consumer prices in the United States accelerating for the first time in 13 months. However, in China, consumer and producer prices fell, pointing to a possible deflationary economy.

“Compared to July 2022, demand for air cargo was basically stable. Considering we were 3,4% below 2022 levels in June, this is a significant and continuing improvement in the trend of strengthening demand that began in February. The evolution of this trend in the coming months will be something to watch carefully. Many fundamental drivers of air cargo demand, such as trade volumes and export orders, remain weak or are falling. And there are growing concerns about how China's economy is developing. Additionally, we see shorter delivery times, which is typically a sign of increased economic activity. Amid these disparate situations, strengthening demand gives us good reason to be cautiously optimistic,” said Willie Walsh, IATA Director General.

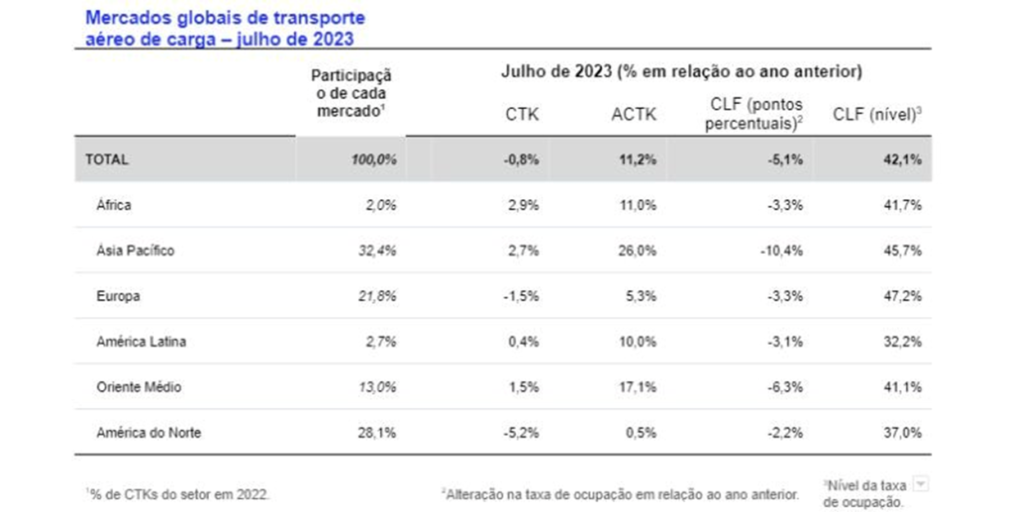

Performance by Region in July 2023

Airlines in the Asia-Pacific region reported a 2,7% increase in air cargo volumes in July 2023 compared to the same month in 2022. This was a significant improvement in performance compared to June (-3,3% ). The region's carriers benefited from growth on three main trade routes: Europe-Asia (3,2% year-on-year growth), Middle East-Asia (from 1,8% in June to 6,6% in July ) and Africa-Asia (returning to double-digit growth of 10,3% compared to the previous year; in June the index was -4,8%). Additionally, intra-Asia trade routes also performed considerably better in July, with annual international CTK declines of 7,5% compared to the double-digit declines seen since September 2022. Available capacity in the region increased by 26,0%. 2022% compared to July XNUMX with the increase in cargo capacity made available on passenger flights.

North American carriers performed the worst among all regions, with a 5,2% drop in cargo volumes in July 2023 compared to the same month in 2022, marking the fifth consecutive month that the region had the worse performance. However, this result represented a small improvement compared to June (-5,9%). The transatlantic route between North America and Europe saw a 4,3% drop in traffic in July, 1,2 percentage points below the previous month. Capacity increased by 0,5% compared to July 2022.

Carriers in Europe recorded a 1,5% drop in their air cargo volumes in July compared to the same month in 2022. However, this result represented an improvement in performance compared to June (-3,2%). Volumes were affected by the performance mentioned above on the route between Europe and North America and by declines in the Middle East-Europe (-1,2%) and intra-Europe (-5,1%) markets. Capacity increased by 5,3% in July 2023 compared to July 2022.

Middle Eastern carriers showed a 1,5% increase in cargo volumes in July 2023 versus June 2022. This result also represented an improvement compared to the previous month's performance (0,6%). Demand on routes between the Middle East and Asia has shown an upward trend in the last two months. Capacity increased 17,1% compared to July 2022.

Carriers in Latin America recorded a 0,4% increase in cargo volumes in July 2023 compared to July 2022. This result was a drop in performance compared to the previous month (2,2%). Capacity increased 10,0% in July compared to the same month in 2022.

Africa's airlines performed best in July 2023, with a 2,9% increase in cargo volumes compared to July 2022. In particular, routes between Africa and Asia saw significant growth in cargo demand ( 10,3%). Capacity was 11,0% above July 2022 levels.

Dux experiences the challenges of the aeronautical sector, having a team of professionals with years of experience in the area, understanding the criticality for each partner. Proximity to the main airlines also means we are able to offer a better scenario given the terms and conditions applied, in addition to being present in more than 150 countries through our network of agents operating 24/07.

Speak to one of our experts and understand how Dux can help your air transport logistics!

Source: Maritime Guide